India’s Role in the Global Recycled Polyester Market: Opportunities and Challenges in 2025

A plastic bottle might seem like an ending, but in the recycled textile world, it’s closer to a beginning. For every spool of fibre made from recycled PET, there’s a supply chain, a policy, a person and a global movement coming into focus.

In 2025, conversations around sustainable textiles are becoming more nuanced, more local, and more urgent. And few regions are at the centre of this shift like India.

Across sourcing floors, trade expos, and sustainability audits, one phrase keeps echoing: recycled polyester market India. This is not just a trend. It’s a global expectation, and India is being watched.

What’s Moving the Needle in 2025

In Europe, France’s AGEC Law is already making recycled content disclosures mandatory for textile brands. In the United States, fashion retailers are being pushed by investor groups to increase transparency in fibre sourcing. Brands that once viewed rPET as a novelty now see it as a baseline.

China has capped recycled content claims on non-certified sources. Japan has committed to increased recycled PET use in textiles over the next several years. According to Textile Exchange’s 2024 report, the demand for recycled polyester has grown steadily since 2018.

This is the context into which the recycled polyester market India is emerging and evolving.

Opportunity: Scale, Access and an Industry on the Move

India has long held a strong position in the recycled PET value chain. But the recycling narrative is gaining more momentum. With an expansive manufacturing base, skilled conversion ecosystems, and a fast-developing infrastructure for collection and cleaning, India is becoming a key hub in the global shift toward circular rPET raw materials.

This makes the India PET recycling industry more than a domestic concern. It is part of how brands fulfill their global sourcing strategies.

Government-led efforts such as extended producer responsibility (EPR) mandates, and investor interest in green supply chains, are converging to accelerate the country’s relevance.

Challenge: Sorting, Scaling, and Global Confidence

Despite the potential, manufacturers and buyers still raise questions:

- Are Indian recyclers delivering batch consistency?

- Can processes ensure feedstock purity for technical applications?

- How traceable are the post-consumer sources?

The answers vary. While many players are advancing rapidly, the India textile recycling trends reveal fragmentation. Some facilities are pioneering advanced sorting, while others still depend on informal sector collection. Investment in infrastructure and certification will define how India is perceived in global buyer matrices.

JB Ecotex: Supporting Circularity With RPSF

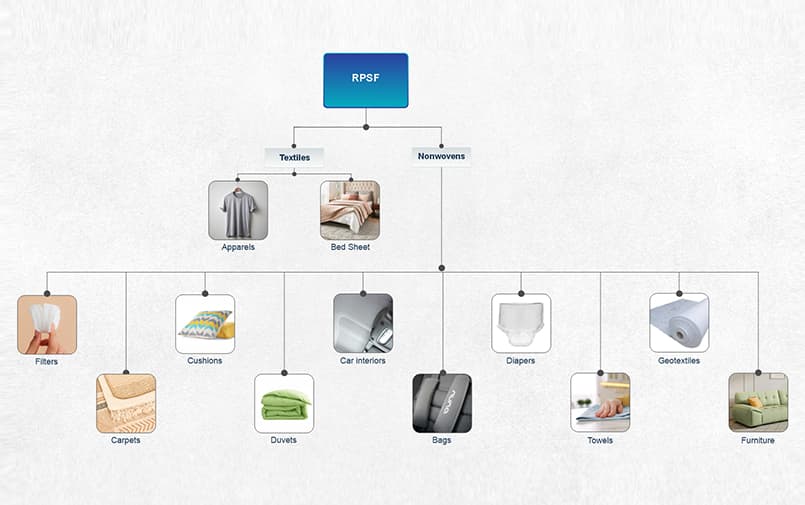

At JB Ecotex, we process PET flakes in-house and produce recycled polyester staple fibre (RPSF) for spinning, nonwovens, and filling applications. Our system is designed to minimise inconsistencies and support traceability.

We offer:

- Hollow and solid RPSF

- Black, white, and coloured fibres

- Grades suitable for stuffing, yarn and nonwoven applications

Stakeholders often ask us:

- Is your fibre GRS-certified?

- What documentation do you offer for exports?

- Can we receive samples for compatibility testing?

We support these needs through collaborative onboarding, supply chain visibility, and responsive technical support.

Learn more about our process and product range.

India’s Role in Shaping Textile Export Sustainability

India’s growing relevance in the recycled polyester market India is directly linked to its export ecosystem. With increasing global pressure on brands to demonstrate textile export sustainability, sourcing managers now prioritise traceable, recycled content.

This has made RPSF and recycled filament yarns key inputs for exporters targeting Europe and North America. Certifications, process documentation, and EPR alignment now sit alongside cost and delivery timelines in buyer expectations.

India is adapting. More companies are auditing upstream partners. More buyers are asking questions beyond price. And more manufacturers are building for long-term alignment, not just short-term volume.

Tracking India Textile Recycling Trends

In 2025, two narratives are emerging in the India textile recycling trends landscape:

1. Chemical and mechanical recycling are beginning to co-exist. More players are piloting textile-to-textile recycling, while PET bottle-based mechanical recycling continues to dominate.

2. Formalisation is accelerating. From blockchain pilots to quality assurance systems, India’s ecosystem is slowly shifting from volume-first to value-and-verification models.

This transformation holds the key to building long-term credibility in the recycled polyester market India.

The B2B Food Packaging Link: PET’s Parallel Market

While polyester fibre gets most of the attention in textile circles, another important application is growing in parallel: food-grade packaging. This is where B2B food-grade resin plays a vital role.

Across India and globally, food-safe PET and rPET resins are being used to create containers, bottles, and trays that meet both safety and sustainability expectations. These resins require high purity levels and often undergo advanced cleaning processes to comply with food safety regulations.

Manufacturers sourcing resin for food-contact applications are increasingly looking for traceability, batch documentation, and compliance with frameworks like FSSAI and international food-contact guidelines.

The synergy between food-grade packaging and the India PET recycling industry is helping elevate quality benchmarks for all recycled PET applications. It reinforces the need for rigorous process control, both in textiles and in packaging.

Global Plastics Market Outlook 2025

According to the Global Plastics Market Report 2025, demand for recycled plastics is being shaped by evolving global regulations, brand commitments, and regional supply advancements. India is noted as a region with increasing infrastructure readiness, especially in sectors like PET recycling, making it a growing player in both the textile and food-grade resin markets.

FAQs: Recycled Polyester and India’s Global Role

1. What is driving textile export sustainability in India?

Global buyer expectations, EPR mandates, and pressure from fashion regulators are pushing Indian exporters to prioritise recycled and traceable inputs.

2. How is the India PET recycling industry changing?

It is shifting from bottle-focused operations to include advanced recycling methods, cleaner flake production, and documentation support.

3. What’s the biggest challenge facing India textile recycling trends?

Consistent quality and full traceability remain key hurdles, especially across smaller collection and processing setups.

4. How does JB Ecotex address these challenges?

Through in-house processing, product documentation, and partnership with customers to build quality assurance from the start.

The recycled polyester market India is no longer emerging. It is participating. The decisions made today about processes, partnerships, and priorities will define whether India becomes a global leader in recycled textiles, or simply a contributor.

At JB Ecotex, we choose to participate with clarity and commitment. Join hands with us. Reach out at connect@jbecotex.com.